How Does RPA Benefit Risk Management?

A sound risk management strategy has secured a direction and paved the way for many financial institutions. It helps businesses ensure that any workflows, financial checks, balances, and processes meet all necessary obligations.

RPA can embolden risk management processes with compatibility, optimized workflows, and a much shorter turnaround time.

Risk Management teams often look to RPA to help bring their risk management strategy to the highest standards required by financial institutions. Non-automated risk management often suffers from errors and delays in processes. Human error leads to failed tests and breached thresholds. RPA integration into risk management processes helps alleviate a lot of these challenges.

Model compatibility

With the computing power that RPA bots hold, they can leverage and overlap econometric and statistical models. RPA can effortlessly read and match dynamic data and perform complex calculations. Since RPA bots are capable of running all day and all week, they can efficiently utilize vendor models, and report and log their findings. Seeing RPA bots in action, one may start wondering why these tasks were ever given to humans in the first place.

An optimized workflow

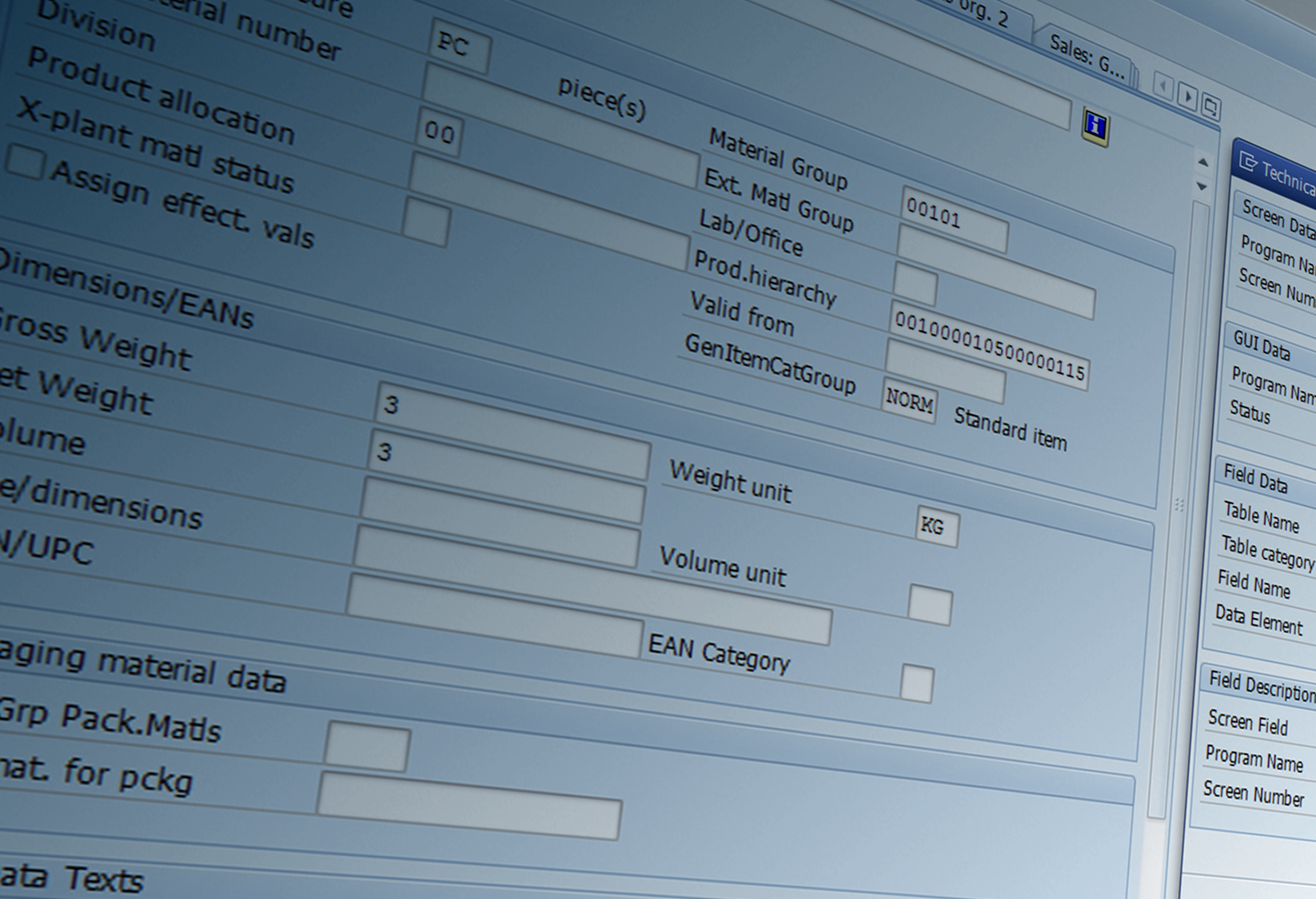

RPA can easily combine the use of several applications simultaneously, running on vendor platforms, Microsoft Office software, and reading and compiling large spreadsheets. This efficiency brings benefits at every stage of a risk management strategy. RPA bots have the capability to keep records of every single action they perform, which means they essentially create audit trails, ensuring that a risk strategy is sound and persistent.

Shorter turnaround time

Leveraging RPA bots' abilities in building spreadsheets, a business can continuously run several tests simultaneously, resulting in a shorter turnaround time. Not to mention that automation significantly improves these tests' quality since human error is removed from the equation. RPA bots can be trained to scan tolerances and flag breaches, which will give a risk management team more time to focus on decision-making.

Quality of life improvements for team members

RPA redefines how team members work. It has a proven positive influence on engagement and work efficiency. By taking over monotonous and time-consuming work, it allows team members to invest into creative and qualitative assignments. Thanks to the additional time on their hands, a leader can direct their team members to gain new skills and operate outside the box. RPA does not replace a workforce. It encourages employees and allows them to reach their thus far untapped potential.

Leveraging RPA bots' abilities in building spreadsheets, a business can continuously run several tests simultaneously, resulting in a shorter turnaround time. Not to mention that automation significantly improves these tests' quality since human error is removed from the equation.

Edyta Pietak,

CSO at AnyRobot

An empowered strategy with RPA

Implementing RPA in risk management processes can be a great asset to professionals since it eliminates many typical problems that traditional risk management often has to face. Additionally, a risk management team that is free from mundane, repetitive tasks can focus its most crucial asset, individual creativity and vigilance, on where it is most needed.